The Allowance for Credit Losses Account Is

Allowance for Credit Losses will be recorded in the balance sheet as a valuation. Accounts receivable were estimated to be 5 uncollectible.

B Com Accounts Receivable And Allowance For Bad Debts Part 3

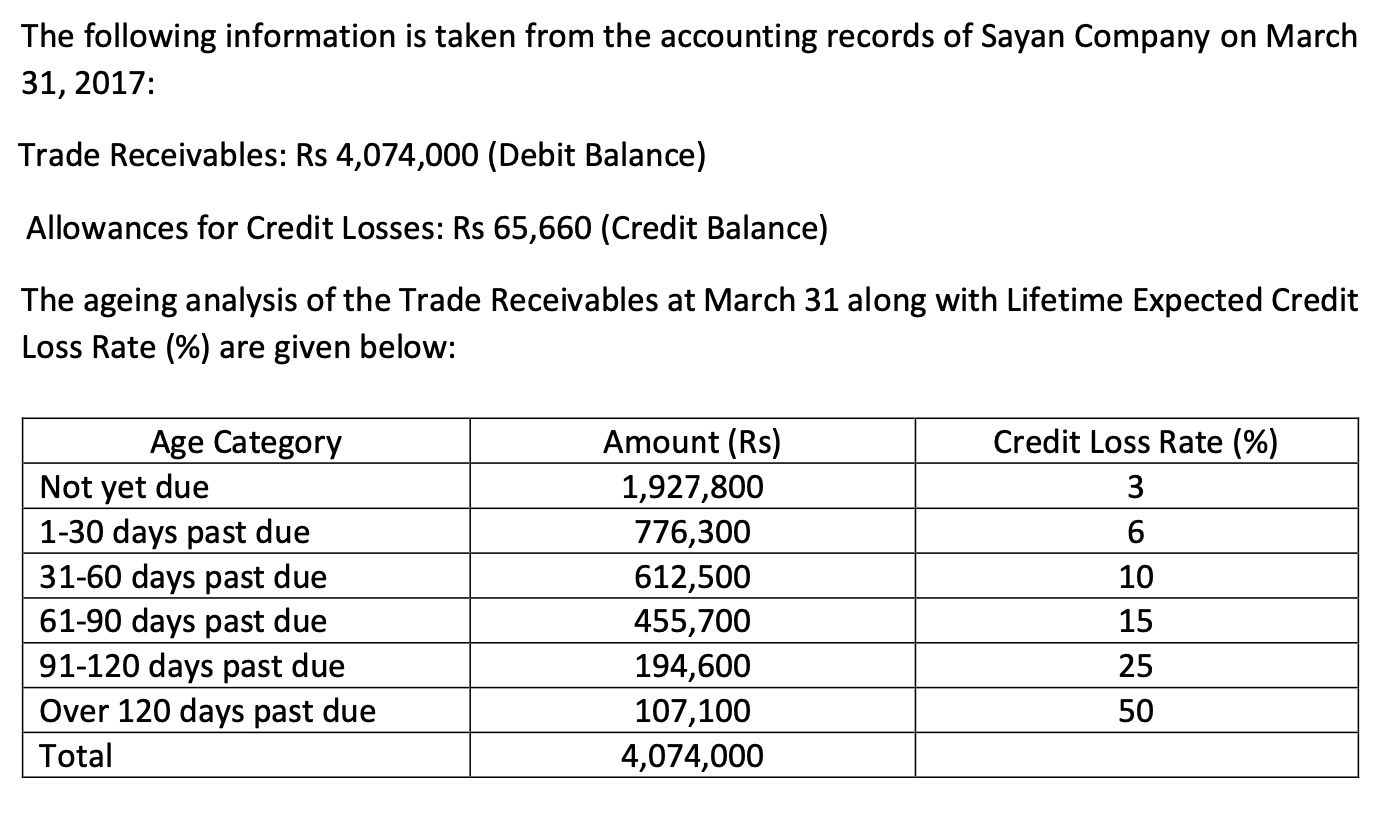

Allowance for doubtful accounts on December 31 1500 x 3 800 x 10 1200 x 20 1050 x 50 890.

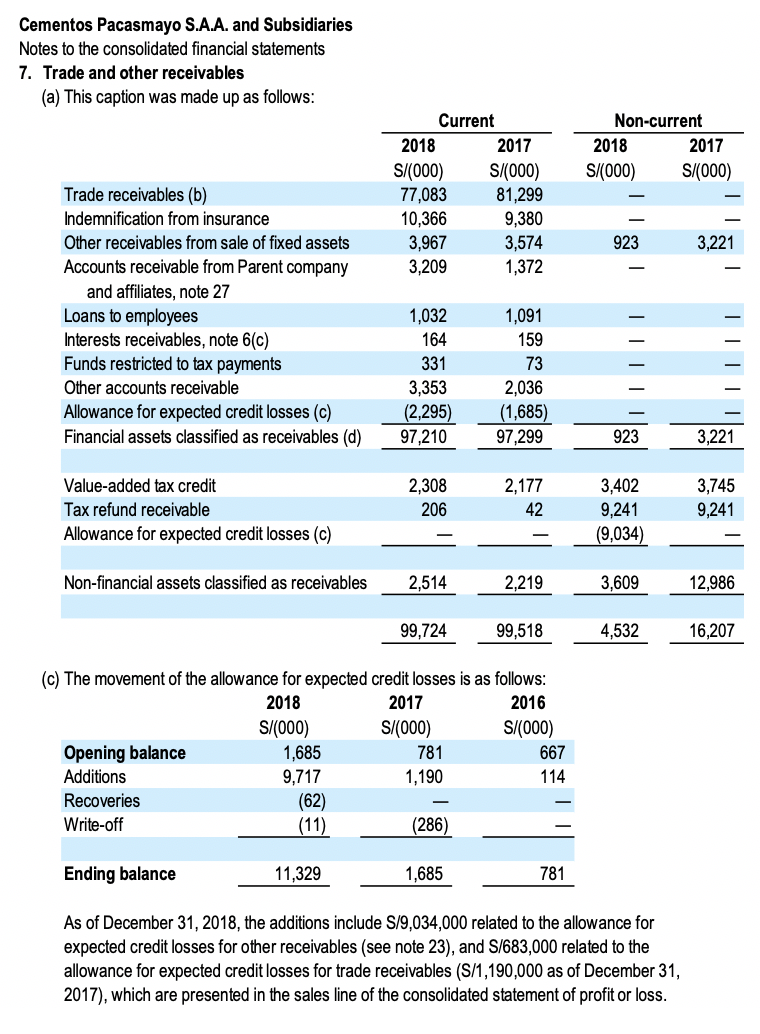

. Allowance for credit losses audit considerations 3 With the adoption of FASB ASC 326-20 and related accounting policies a key consideration of the auditor is the effectiveness of internal control over the expected credit loss estimation process and the financial reporting of loans in accordance with FASB ASC 326-20. A Bad Debts Expense 5800 Allowance for Doubtful Accounts 5800 B Bad Debts Expense 4600. The general ledger balances for the accounts receivable and the related allowance account were 1000000 and 40000 respectively.

Is the current asset resulting from a sale or service executed on a credit basis 2. Allowances for Credit Losses is prepared for OCC examiners in connection with the examination and supervision of national banks federal savings associations and federal branches and agencies of foreign banking organizations collectively banks. In this case we can determine the allowance for doubtful accounts with the calculation as below.

Subtracted from net account receivable. Chapter 8 Notes - accounting for receivables Learning Obj 1. Allowance for credit losses bal.

The line item can be. Businesses extend credit in order to increase their volume. The lender is required to set up an allowance for credit losses that contains its best estimate of how much this bad debt.

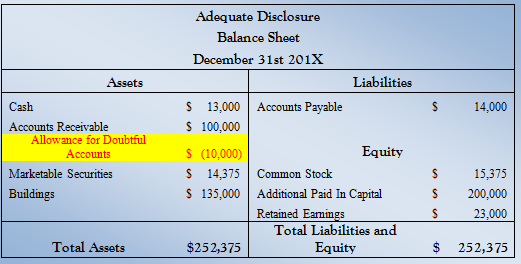

By reporting the 10000 credit balance in Allowance for Doubtful Accounts Gem is also adhering to the accounting principle of conservatism. If Edsel uses the gross accounts receivable approach for estimating the allowance for credit losses the allowance for credit losses account after the proper adjustments to the accounts are recorded should show a balance of. At December 31 the Allowance for Doubtful Accounts had a credit balance of 1600.

Foster uses the percentage-of-receivables method to estimate its allowance for credit losses. Adjusted its allowance for credit losses at year end. The adjusting entry to record credit losses is.

However the matching principle is better met by Gem making these estimates and recording the credit loss as close as possible to the time the sales were made. Recording Allowance For Credit Losses. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a companys balance sheet and is listed as a deduction immediately below the accounts receivable line item.

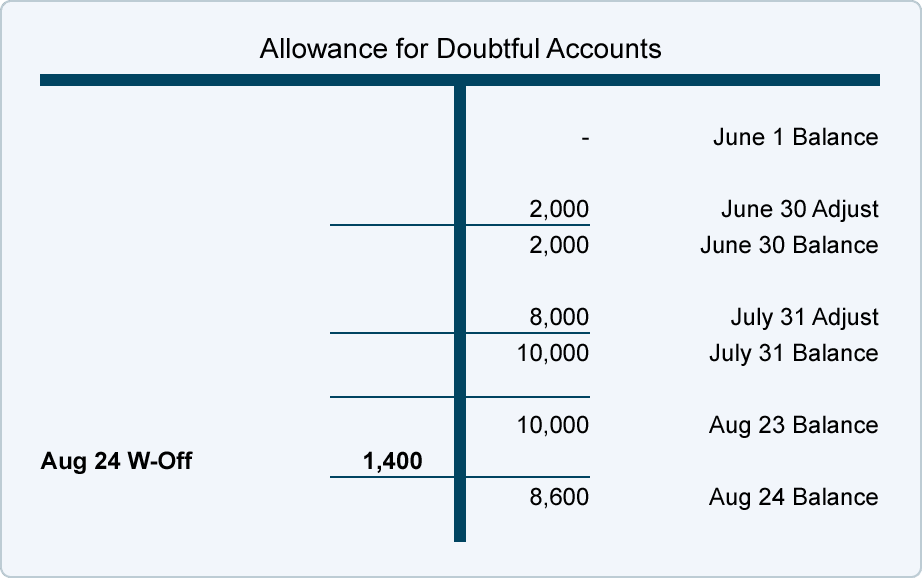

The allowance for credit losses is the difference between the amortized cost basis and the present value of the expected cash flows. Above we assumed that the allowance for doubtful accounts began with a balance of zero. As of June 30 when it issues its first balance sheet and income statement its provision for credit losses will have a credit balance of 2000.

River Forest estimated that 2 of current balances and 15 of past-due balances will prove uncollectible. When a lender issues loans there is a chance that some portion of the resulting loans receivable will not be collected. While the allowance account is recommended for the companys financial statements it is not acceptable for income tax purposes.

Added to net accounts receivable. Added to gross accounts receivable. Subtracted from gross accounts receivable.

Financial investment debt holders now will recognize an allowance for credit losses which is a valuation account for the cash flows that it does not expect to collect. The CECL methodology replaces the incurred lossimpairment methodology in current GAAP. O subtracted from gross accounts receivable.

Loss-Rate Methodology Under a loss rate approach loss rate statistics are developed on the basis of the historical rate of loss of the financial assets. 1 The allowance for credit losses account is 33 Points subtracted from net account receivable. Added to gross accounts receivable.

The allowance for credit losses account is. 8 hours agoStandard allowance per month For those single and aged under 25 the standard allowance has gone up from 25733 to 26531 For those single and aged 25 or over the standard allowance has. The new standard introduces the current expected credit losses CECL methodology for estimating allowances for credit losses.

Losses from accounts receivable a. Under current GAAP recognizing credit losses is delayed until a probable loss has been incurred. Accounting receivable losses from uncollectible accounts allowance method of accounting for doubtful accounting 1.

Added to net accounts receivable. The credit balance in the allowance account is an estimate amount in an adjusting entry that debits the income statement account Bad Debts Expense and credits Allowance for Doubtful Accounts. In other words if there is some doubt as to whether there are 10000 of credit.

Hence the allowance for doubtful accounts increase by 390 890 500 during the accounting period. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. The debit to bad debts expense would report credit losses of 50000 on the companys June income statement.

Thus a credit loss may exist at the financial asset acquisition or origination and until the financial asset is settled or disposed of. The allowance for credit losses is a valuation account that is deducted from or added to the amortized cost basis of the financial assets to present the net amount expected to be collected on the financial asset. The allowance for credit losses is a reserve for the estimated amount of loans that a lender will not collect from its borrowers.

The standard allowance is rising from 32484 to 33491. The allowance for credit losses account is. 11 hours agoUniversal Credit payments will rise from today giving benefit claimants more money in their account amid the cost of living crisis.

Since a certain amount of credit losses can be anticipated these expected losses are included in a balance sheet contra asset account. Added to gross accounts receivable. Allowance for credit losses Allowance for credit loss is a high-risk account due to the nature of this account it is an estimate of the debt that PacWest is unlikely to recover representing the estimated bad debts held by charge to an adjusted valuation reversal through PacWest operating income.

Added to net accounts receivable.

/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

Allowance For Credit Losses Definition

Accounting Of Allowance For Bad Debts Financiopedia

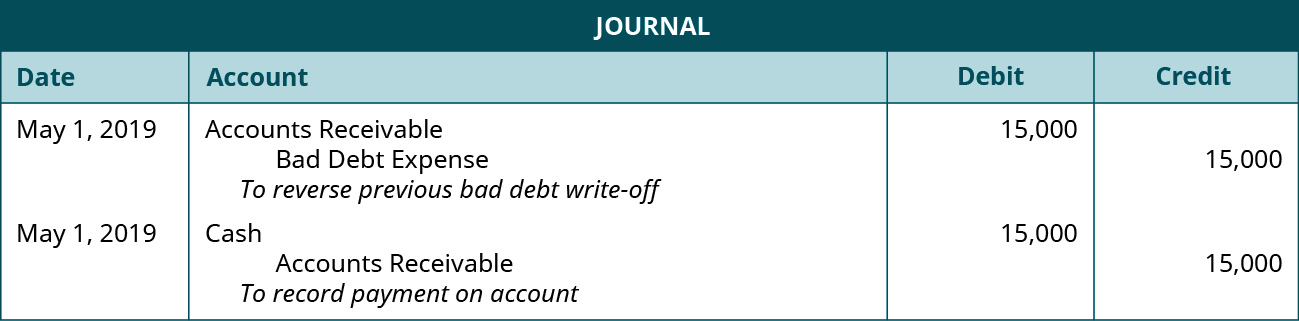

Change In Bad Debts Allowance And Subsequent Recovery Of Bad Debts Financiopedia

Credit Risk And Allowance For Losses Accountingcoach

:max_bytes(150000):strip_icc()/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

Allowance For Credit Losses Definition

What Is The Allowance Method Online Accounting

Solved Calculate The Amount Of Allowance For Credit Losses Chegg Com

A Record The Changes In The Allowance For Doubtful Chegg Com

/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

Allowance For Credit Losses Definition

Credit Risk And Allowance For Losses Accountingcoach

Credit Risk And Allowance For Losses Accountingcoach

Allowance For Impairment Of Trade Receivables Unbrick Id

Credit Risk And Allowance For Losses Accountingcoach

The Difference Between Bad Debt And Doubtful Debt Online Accounting

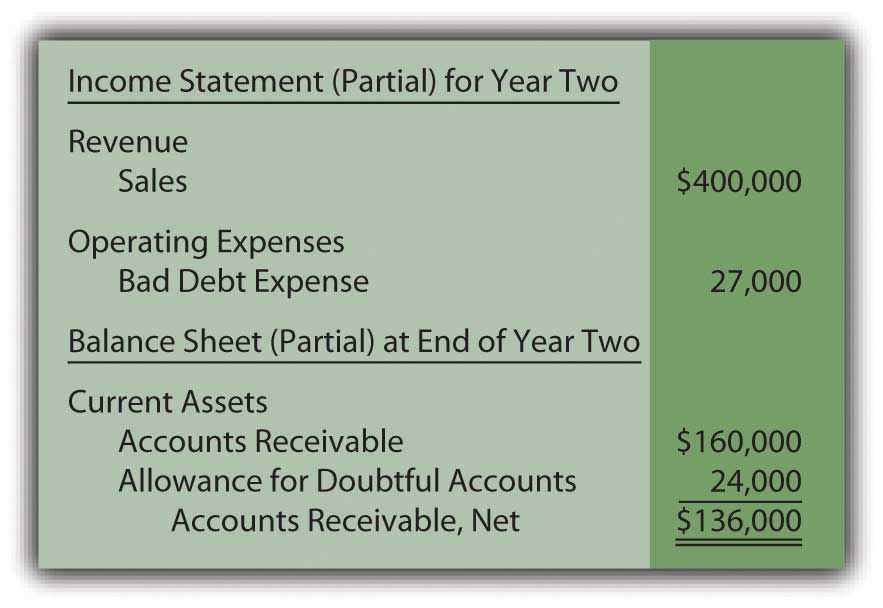

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Expected Credit Loss Model Example For Trade Receivables Unbrick Id

Accounting Of Allowance For Bad Debts Financiopedia

Good Debt Vs Bad Debt Know The Difference Simple Accounting Org

B Com Accounts Receivable And Allowance For Bad Debts Part 3

Comments

Post a Comment